skip to main |

skip to sidebar

我的天,我的地。。。

My land, my way...

About Me

- skeng

- Seri Kembangan, Selangor, Malaysia

- Food lover

Stories...

-

►

2008

(1)

- ► January 2008 (1)

-

►

2007

(9)

- ► December 2007 (1)

- ► November 2007 (1)

- ► October 2007 (2)

- ► September 2007 (1)

- ► April 2007 (3)

-

▼

2006

(26)

- ► December 2006 (3)

- ▼ November 2006 (12)

- ► October 2006 (4)

- ► September 2006 (4)

- ► August 2006 (3)

Photos

- Great Ocean Road (April 2009)

- Park and misc

- New Quay, Dockland

- Williamstown

- Mix photos in Melbourne (Last week of 2007)

- Mix photos in Melbourne (December 2007)

- Melbourne city (November 2007)

- Mornington Peninsular

- St. Kilda

- Royal Botanical Garden at Melbourne

- Shrine of Remembrance

- Melbourne Zoo

- Motor GP 2007

- ECI Annual Dinner at Melbourne

- Melbourne Aquarium

- Tasselaar Tulip Festival

2 句话 :

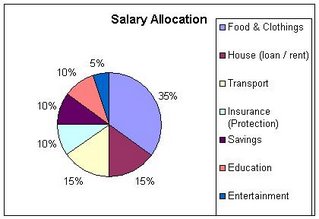

i would think that it gives a base idea on how we should plan our allocation. However, each individual will need to customise base on our own financial status.

E.g. if we earn RM 1000 per month, 15% might not be enough to pay for rental or house loan. So we might need to 'borrow' a little bit from transport.

or if we earn RM 5000 per month, then 35% for food and clothings might be too much, so as 15% for transport. Then we should increase the savings.

my experience is that the housing and car loan will take up a huge chunk ...

theekit

Post a Comment